On a quiet Sunday morning at a retreat center tucked among the pines, Nik Johnson stood before a small crowd—not to preach about sin or salvation, but about a very different kind of fire: Financial Independence, Retire Early, or FIRE.

“Financial independence isn’t really just about us,” he told the group. “It’s about the people we love and the causes that matter to us.”

This gathering was Camp FI, a weekend where early retirees and soon-to-be retirees trade spreadsheets for campfires and swap stories about how they escaped the grind long before their peers.

Love, Coupons, and the Art of Saving

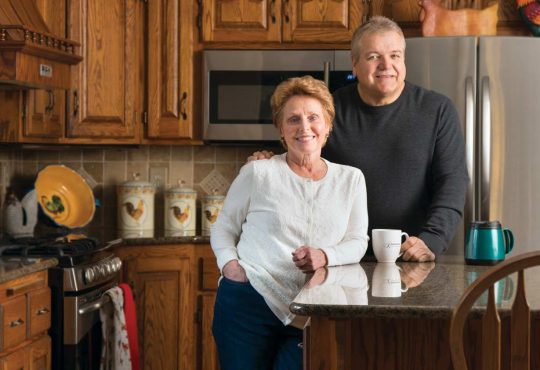

When Nik met his wife, Adinah, three decades ago, she learned something about him right away: he was a saver.

“Our first date, he pulled out a coupon,” she laughed.

Nik grinned at the memory. “I figured if she had a problem with a coupon, she wasn’t my soulmate.”

Adinah didn’t just approve—she doubled down. “I asked him how many more coupons he had!”

That shared mindset became the backbone of their financial success. Nik built a career in software while Adinah worked in education. Their salaries were modest, but their discipline was powerful. They lived below their means, paid off their mortgage, and eventually saved $1.6 million—all while racking up more than 300,000 miles on their trusty old minivan, affectionately named Big Red.

Discovering FIRE

From the beginning, Nik had one quiet dream: to stop working by 50. He wasn’t sure how to make it happen—until a late-night internet search during the pandemic led him to the FIRE movement, and eventually, Camp FI.

There, he met others like him: people determined to rewrite their financial stories by saving aggressively, living simply, and reclaiming their time.

The modern movement traces its roots to Peter Adeney, better known online as Mr. Money Mustache, who famously retired at 30. “So much of modern life is inefficient,” he said in an interview. “We spend money without thinking, just because everyone else does. Once you stop following the crowd, you realize how much freedom is hiding in simplicity.”

Now turning 50, Adeney says his early retirement has made life feel fuller. “I’ve lived more in these 20 years than I probably would have in 60. But quitting your job doesn’t automatically fix everything—you still have to face yourself.”

The Philosophy of Enough

Another key figure in the FIRE world, Vicki Robin, co-author of the personal finance classic Your Money or Your Life, takes a gentler approach. Her philosophy centers on redefining what “enough” really means.

“When you get clear on what truly matters, you realize that every dollar represents your life energy,” she says. “The less you waste, the more life you get back.”

For many in the FIRE movement, the formula is simple but powerful: save and invest about 25 times your annual expenses, then live off roughly 4% of your savings each year.

But Robin emphasizes that it’s not just about quitting your job—it’s about liberating your time to pursue what feels meaningful. “I like to say I buy my freedom with my frugality every day,” she adds.

Living the Reward

For Nik and Adinah, that freedom now defines their family’s life. With three kids, their days are still busy—but not rushed. They spend less time chasing possessions and more time creating memories.

“The kids won’t remember every toy we bought,” Nik said. “But they’ll never forget the family trips we took or the time we spent together.”

When asked what an average day looks like now, Adinah smiled. “I still run errands, pick up the kids, and take my son to football practice. It’s life, just slower and sweeter.”

Nik chuckled. “She’s busier than I am—I’ll probably sneak in a round of golf.”

A reporter teased, “Sounds like one of you might be more retired than the other.”

“Exactly,” Nik laughed. “That’s the real FIRE—figuring out what freedom looks like for each of us.”